Sustainable Finance

Companies of the future are sustainable, low carbon, and resilient to climate change.

The development and implementation of climate action technology, projects, strategies, and models are central to building a low-carbon future that is resilient to climate change. Through our services we promote an economy in line with the Paris Agreement, the SDGs (Sustainable Development Goals), the post-COVID green growth and recovery strategies, with the aim of improving the environmental, social and governance management of the public and private sectors throughout the Latin America and the Caribbean region.

Our Services

Sustainable finance and its correct implementation ensure sustainable development and promote the appropriate conditions to meet the needs of our current population without compromising the future of generations to come.

Recently, banks and financial institutions have opted for strategies that go beyond maximizing the economic benefit of their activities, beginning to actively invest in sustainability. Sustainable finance covers a broad spectrum of investments that can be summarized in 5 levels:

Green finance is a subset of sustainable finance. Green finance is defined as increasing the level of financial flows (from banking, microcredit, insurance and investment) from the public/private and non-profit sectors to environmentally friendly development priority areas. The goal is to manage environmental risks and take advantage of opportunities provided by environmental benefits with a decent financial rate of return.

Examples include Green Bonds, Green Banks, Carbon Finance and Community Green Funds, all of which are financial instruments that have the same objective

Climate finance is a subset of green finance, and in a broad sense of the word, climate finance is any type of financing used to mitigate the effects of climate change. However, more specifically, climate finance refers to all financial flows from developed countries to developing economies to cooperate and combat the effects of climate change, such as greenhouse gasses (GHG). And at the same time help them develop and invest in technologies and resources that actively combat these effects, such as the development of solar plants and wind energy.

The ESMS is a tool that allows anticipating, minimizing, and/or mitigating the adverse environmental, social, and climatic impacts associated with a certain activity. We provide advice to incorporate environmental, social, and climate risks in the credit process and decision-making of your financial institution, looking at all the best international practices:

* Risk analysis of the institution and its project portfolio.

* Analysis of documentation on environmental, social, and climate issues.

* Gap analysis regarding best practice and risk level.

* Development of Environmental, Social, and Climate Policies.

* Strengthening or implementation of SARAS in the institution's processes, aligned with best practice and international requirements.

* Action plan to closing gaps.

* Preparation of manuals and guides.

* Implementation of SARAS at the pilot level.

* Technical assistance for continuous improvement.

* Monitoring system.

* Training for employees in SARAS management.

* Development of the financial strategy taking into account all the particularities and challenges faced by the client.

* We offer both traditional financing tools and innovative schemes.

Benefits:

• Reduce the credit, legal and reputational risks to which the institution is exposed.

• Improve the overall quality and risk profile of your loan portfolio.

• Optimize the credit granting procedure, with a transparent and standardized system for collecting information and evaluating risks.

• Comply and align with national regulations and international standards.

• Access new sources of financing.

• Generate new market opportunities, services, and products.

• Identify clients that require greater support for the management of environmental, social, and climatic risks.

• Protect the interests of the financial institution.

ESG criteria are a set of rules to be followed by companies when making decisions. In this way, ESG criteria evaluate investments or other financial actions beyond their profitability or economic performance. This allows the business sector to be analyzed from different perspectives, beyond a purely economic focus. Improving these criteria can mean greater productivity for the institution, greater access to sustainable/green financing sources, and the possibility of accessing new markets. Following internationally recognized guidelines, we support the incorporation of ESG criteria within your company:

* Climate change

* Natural resources

* Biodiversity

* Environmentally Friendly Technology

* Local communities

* Employees

* Production Chain

* Diversity

* Corruption

* Tax Practices

* Accountability

* Transparency

Benefits:

ESG criteria give us a more representative spectrum of company values. By analyzing these criteria as a whole, we gain a better understanding of the assets available, as well as more informed investment decisions.

Do more with less

Corporate eco-efficiency is a concept increasingly used as a strategy to achieve adequate environmental management, promoting sustainable development. These efficiencies translate into cost reduction for the institution, improvement of the institutional image and reduction of the impact caused. Through this service we provide advice to companies so that they can achieve efficiencies in their activities, focusing on 3 fundamental pillars:

We provide advice for the efficient use of water, its proper operation, and maintenance of the facilities that ensure the reduction of water consumption in different tasks thanks to the installation of water saving systems, campaigns to promote employee participation, monitoring, statistics and dissemination of goals and achievements.

We provide alternatives for the efficient use of electrical energy, savings in lighting and office equipment, monitoring, follow-ups, and dissemination of goals and achievements, optimizing processes, and reducing the consumption of resources and operating costs.

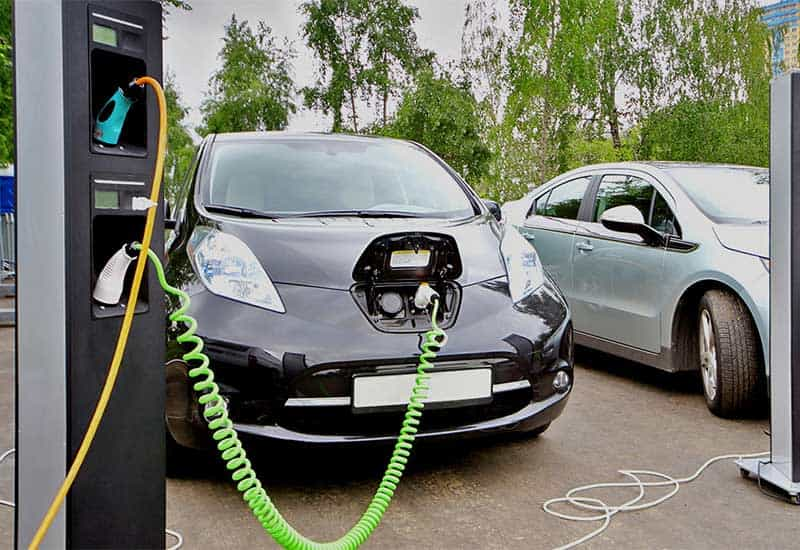

We offer advice on choosing environmentally friendly vehicles, increasing the efficiency of mobility solutions with the aim of responding to the pressing issue of climate change through policies for the efficient use of transportation.

Benefits:

• Cost savings.

• Energy saving.

• Carbon Footprint Reduction.

• Reduction of solid waste generation.

• Compliance with current environmental regulations and anticipation of future regulations.

• Enhancement of value chains.

• Reduction of environmental risks.

• Improvement of corporate image.

• Greater market opportunities.

The development of services and products in line with sustainable, green, and climate financing trends is essential for financial institutions. These products will be part of the future of credits and the green taxonomy worldwide. Through this service, we provide advice to financial entities for the development, validation, and commercialization of these new products in line with the trends of sustainable, green, and climate financing.

Analyze different options of green financial instruments that are aligned with the global green taxonomy and are intended to finance or refinance, partially or totally, new and/or existing projects that are eligible as green.

Develop a portfolio of green operations that include interventions in natural capital and climate change mitigation and adaptation measures. Promote strategic alliances with investors and international partners, such as specialized funds and subnational governments. Support the transition of the business fabric towards sustainable and resilient production models that comply with greenhouse gas reduction commitments and enhance productivity, innovation and digitalization.

Specialized and personalized training on green taxonomy, sustainable, green and climate financing, and environmental and climate management for financial institutions.

Featured projects

Do you need our services?

We offer you the professional advice you need